Taps Coogan – February 13th, 2024

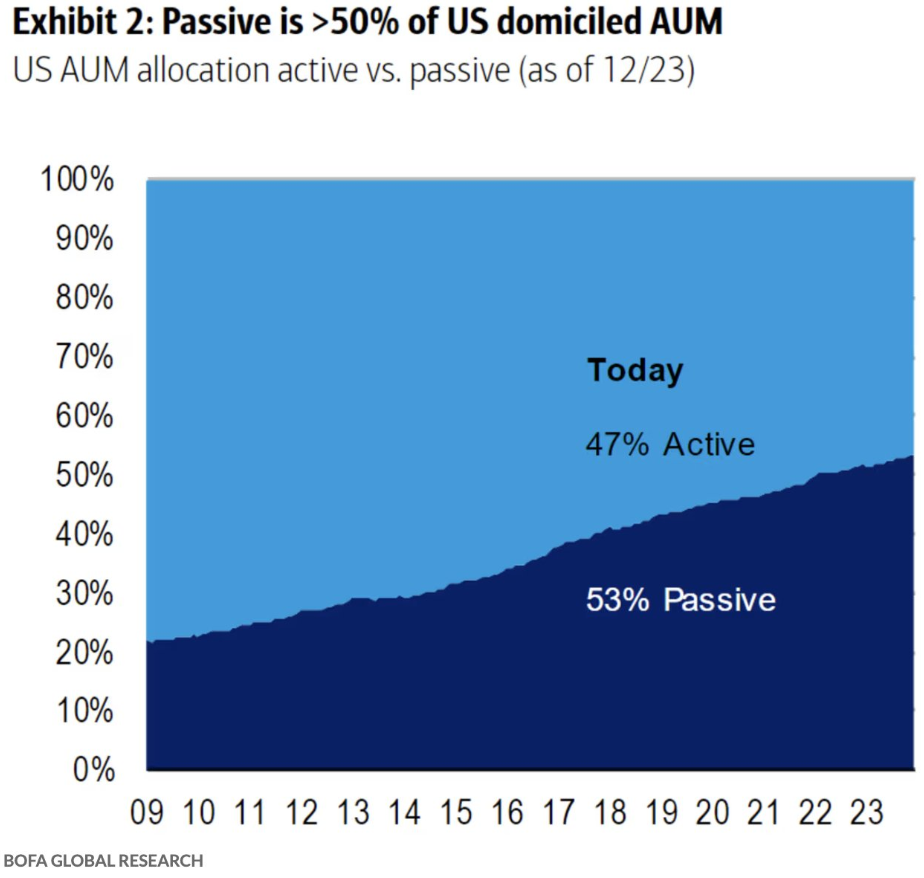

It’s been a long time coming but we’ve finally arrived: a majority of assets under management in the US are now invested in passive funds. Via Holger Zschaepitz:

Passive funds have overtaken active. That’s changed a lot b/c the number of active managers is down a lot, David Einhorn says in MIB podcast: "There’s entire segments now mostly in the smaller part of the market where there’s literally nobody paying any attention…I view the… pic.twitter.com/aMqxEZ5DXx

— Holger Zschaepitz (@Schuldensuehner) February 13, 2024

Perhaps best articulated by Nassim Taleb’s Fooled by Randomness all the way back in 2001 (mandatory reading for investors), the reality is that the overwhelming majority of active managers (and retail investors) underperform benchmarks such as the S&P 500 or the Russel 3000 over long periods of time. In others words, they under perform various measures of the ‘average’ performance of US listed stocks, meaning that their performance is worse than what one might expect from random chance.

That reality has led an ever larger number of people to realize that they are better served by investing in passive ETFs than paying people that have no demonstrable skill to do worse (or to try themselves). That’s all well and fine and a very important reminder that prognosticating about ‘macro’ economics and markets, as we do here, should not be confused with an approach investing, a distinct discipline that we discuss extremely rarely here.

All that being said, there is something regressive about an ever greater percent of capital being directed at passive instruments. For markets to function properly and generate returns for investors, they must be making endless capital allocation decisions and enabling price discovery. That inescapably depends on active investment decisions and while any individual active investor is likely to underperform, assets accrue to the few who out-perform, creating a ‘paradox’ where markets outperform their average constituent. But what happens when there aren’t any active managers left?

We’re not there yet, but we are asymptotically converging towards it. It probably means markets are getting less ‘efficient’ which is hardly a bad thing for those active investors who actually know what they’re doing, but may spell trouble for the indexes.

The post Passive Funds Finally Overtake Active Management appeared first on The Sounding Line.